In this Security Advisory issue, we will look into how some of the recent investment scams are conducted, and provide tips to investors on how they can prevent falling victim to such scams. [First published on 27 Sep 2024]

Based on a recent report released by the Singapore Police Force (SPF) on 22 August 2024, the total number of scam and cybercrime cases saw a 16.3% increase YoY in the first half of 2024, while the total dollar amount lost due to scams in the first six months of 2024 rose by 24.6% to at least S$385.6 million, as compared to the same period last year.

In terms of reported cases, the top five types of scams are e-commerce scams, job scams, phishing scams, investment scams, and fake friend call scams. Out of which, investment scam victims suffered the most losses financially, amounting up to S$133.4 million in total amount lost to investment scams. Job scams, which was discussed in our previous Security Advisory article, saw the second highest amount lost to scams in the first half of the year.

This issue will look into how some of the recent investment scams are conducted, and provide tips to investors on how they can prevent falling victim to such scams.

How do Scammers Reach Out to their Victims?

The SPF has also released an infographics article to highlight the top 5 different methods engaged by scammers to reach out to their victims:

Source: https://www.police.gov.sg/-/media/07167F3D6D6D4C44877BB67A1B219285.ashx

Out of the different contact methods, in terms of messaging platforms, more than 95% of the scam cases happened on WhatsApp and Telegram, at 50.2% and 45.0% respectively, while around 3.1% of the reported scams took place on Wechat. Telegram scams have surged by 137.5% on a YoY basis, and investment scams took up the highest proportion of scams conducted via Telegram. Apart from messaging platforms, social media, including Facebook, Instagram and TikTok, have also saw an increase in scams reported.

With a rise in scams conducted through digital platforms, the majority of scam victims in the first half of the year have been adults who are under the age of 50, making up 74.2% out of the total number of victims. On the contrary, adults from the age of 50 to 65 and above tend to fall victim to investment scams.

How do Investment Scams work and what are the signs to look for?

These are some of the more prevalent types of investment scams in recent times:

1. Messaging platforms investment scams

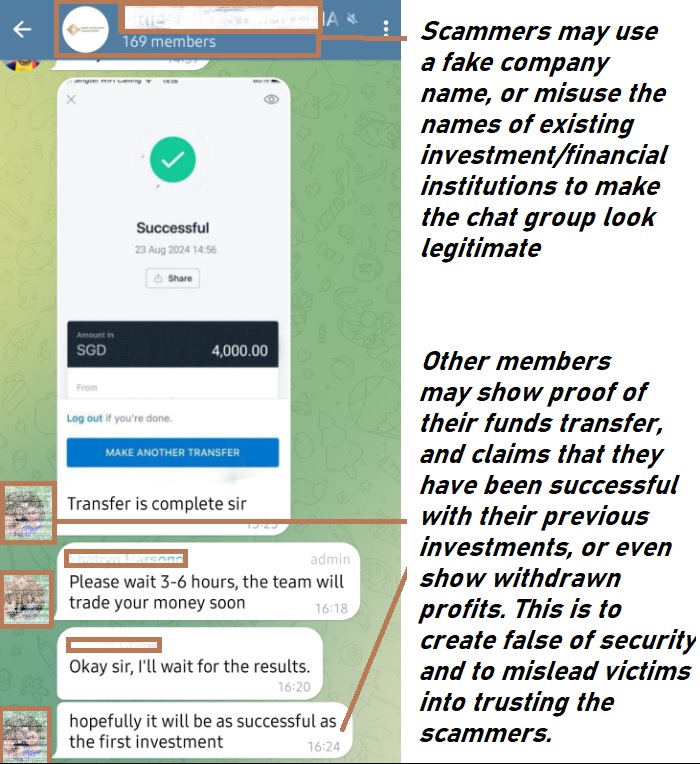

The following are some of the signs to look out for that you may be targeted for an investment scam:

Added to Random Chat Groups: Scammers add unsuspecting victims to group chats or channels on messaging apps (such as WhatsApp and Telegram) that offers “investment opportunities”.

Using Fake Investment Company Names or Impersonating Legitimate Investment Companies: Within the chat groups, these scammers may claim to represent fake investment companies, or even impersonate established and legitimate financial institutions, including banks, investment platforms, stockbrokers, wealth management companies and etc.

Scam Associates Providing False Testimonials: The scammers may arrange for associates to infiltrate the chat groups, where they may claim to have made profits from their previous investments and have received the profits successfully, in order to create a false sense of legitimacy. They may also share in the chat group, fake screenshots of their bank transfers to the chat group admin, or even photos of stacks of cash that they claimed are their investment profits. If there are other chat group members who cast doubts over the legitimacy of the investments, these associates may also defend the scammers. The “admin” of the chat group may then suggest the victims to start investing with smaller amounts of monies to test out the investment schemes.

Revealing Personal Information and Putting in Investment Requests: Victims who are convinced by the positive reviews and investment results from the other chat group members, may then be lured into providing personal information and transferring monies to the scammers to start investing.

Hidden Fees and Lost Funds: After the “investments” have been made, the scammers will then approach the victims to pay hidden fees to withdraw their "profits", but the victims eventually will still be unable to withdraw their capital and profits, and it is only then that they realise that they were victims of scam and have ultimately lost their monies.

An example of a Telegram scam chat group:

2. Web-based / social media investment scams

These are the tactics used by scammers when approaching their victims through the internet and social media, and these are the red flags to look out for:

Encountering Investment Scams Online: Victims may come across “investment opportunities” through various channels, including Internet search results, video advertisements on platforms such as Youtube, advertisements on social media, or even recommendations from personal contacts as well as unsolicited social media and text messages from complete strangers.

Misleading Identity & Testimonials: Scammers tend to impersonate employees of established financial institutions, or use fake testimonials and investment results to lure victims into believing that the scammers will be able to generate good investment returns.

Building Relationships: Some scammers establish trust by befriending victims first, before introducing investments opportunities after getting to know the victims better.

Fake Investment Platforms: Scammer may convince victims to download fraudulent investment apps or visit web-based investment portals to open an investment account to experience the investment process themselves. During such a process, victims may be phished, as they will inevitably be sharing their personal details with the scammers while opening an investment account, or they may be downloading spyware or malware unknowingly onto their mobile or desktop devices.

Transferring Money: After believing in the legitimacy of the investments, victims may then start to transfer monies to scammers’ accounts or wallets (including cryptocurrency) in order to kickstart their investments.

Baiting with Real Profits: Initial “profits” may be given to victims in some cases to create a false sense of security and to make the investments seem genuine, in order to encourage the victims into putting in higher amounts of investment.

Unable to Withdraw Monies: Victims may only realise that they have been scammed when they face issues withdrawing their investment capital and subsequent “profits” from the scam app/platform.

3. Pump-and-dump and other types of market manipulation scams

-

As highlighted in previous Security Advisory issues (Spot investment scams; Stop investment scams - Pump and Dump? Jump Away!), “Pump and Dump” scams are a way of stock market manipulation, whereby the scammers gave investment tips to victims whom they have chatted up with on social media platforms, or have randomly added into chat groups on messaging apps. The friends and/or chat group admin may profess to be experienced investment experts or possess insider news, in order to convince them into investing stocks of a listed company (particular penny stocks), and during the process “pump” up its share price. The scammers will subsequently “dump” the company shares at artificially high prices, benefitting themselves while their victims will still be holding on to shares that have lost their value, and eventually run into investment losses.

There may be other types of scenarios, whereby individuals have attempted to influence and manipulate the price of a stock, by spreading falsehoods online, either causing interest or fear towards a particular listed company. In a case recently reported on Channel News Asia, an individual was convicted for illegally manipulating the market with multiple trading accounts, where he also fabricated claims on in a Telegram chat group that he has set up with his co-conspirator, misleading the chat members into following him into investing in the shares that he already has interest in. He manipulated, with multiple trading accounts opened using his family members’ information, and created buy and sell trades which he did not intend to fulfill, and during this process, he managed to forge fake interest in these securities, in order to induce other market participants to trade at prices that benefit him. Chat group members or other market participants who have followed his trading trends, may incur losses due to the fraudulous trading behaviour, which “distorts and interferes with the proper discovery of price and market demand for securities” (quoted from Channel News Asia – “Grab driver in SGX market manipulation case gets jail and fine of more than S$355,000”, Published on 19 Dec 2022).

How to prevent falling victim to investment scams

Be Wary of High Returns with Low Risk: Exercise caution if an investment opportunity promises unusually high returns with minimal risks.

Verify Identity and Authenticity: Always verify the background of the person or company offering investment tips. Contact the company that the scammers claim to represent, in order to verify their identity and to authenticate the investment schemes.

Exercise Caution with Online Recommendations: Be cautious of investment tips from online forums or social media chat groups. Conduct proper due diligence first before following any of such recommendations or claims.

Do Due Diligence: Avoid blindly trusting claims from chat groups or from any online sources. If unsure, investors should consider engaging the assistance of a professional and licenced financial adviser/wealth planner to guide them through their investment journey.

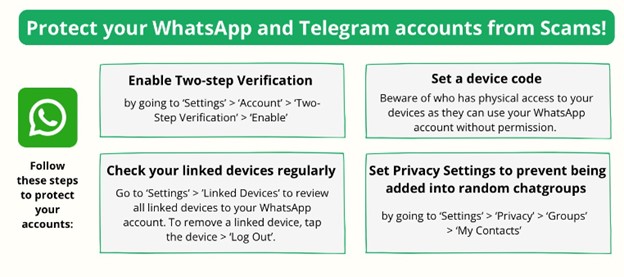

Avoid Unsolicited Messages and Groups: Be mindful when you have been added to messaging platforms without permission. Take proactive steps to protect yourself from receiving unsolicited or potentially scam-related messages:

Source: https://www.police.gov.sg/-/media/7F27E7269C7F44F0A278D23C569A354D.ashx

Recent scams misusing the identity of iFAST Corp and our subsidiaries

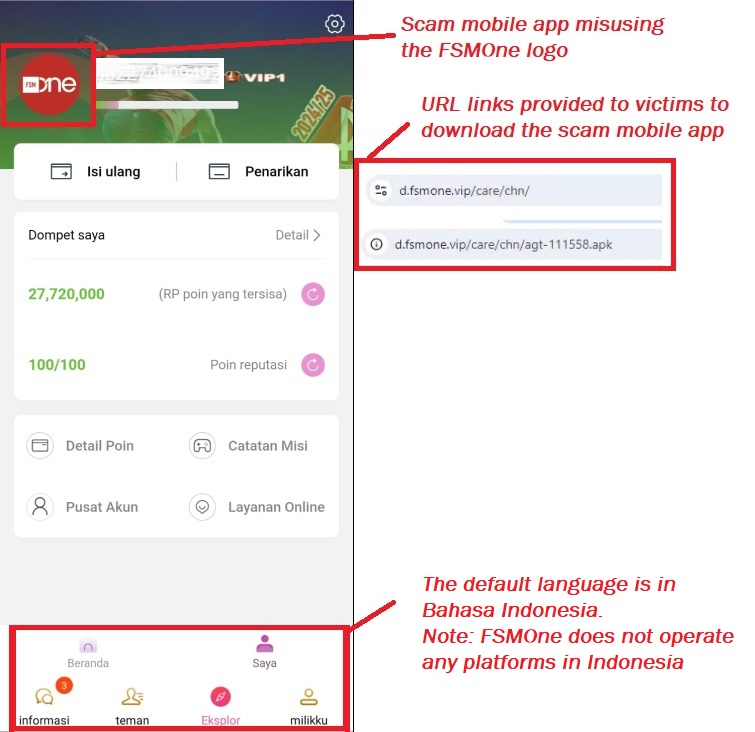

Fraudulent mobile app in Indonesia misusing FSMOne logo:

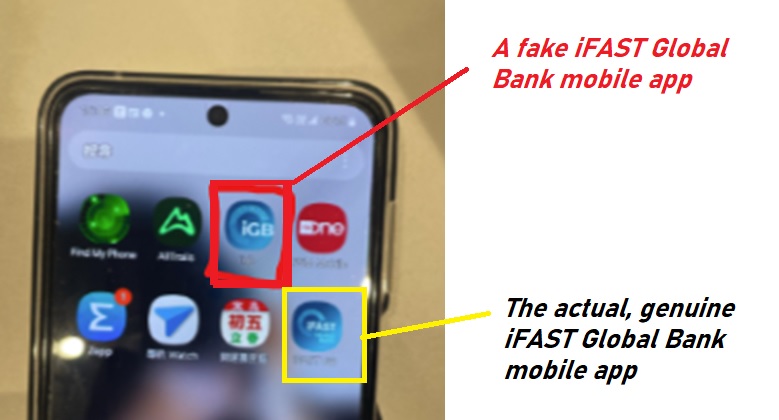

Fraudulent mobile app with logo similar to the logo of iFAST Global Bank:

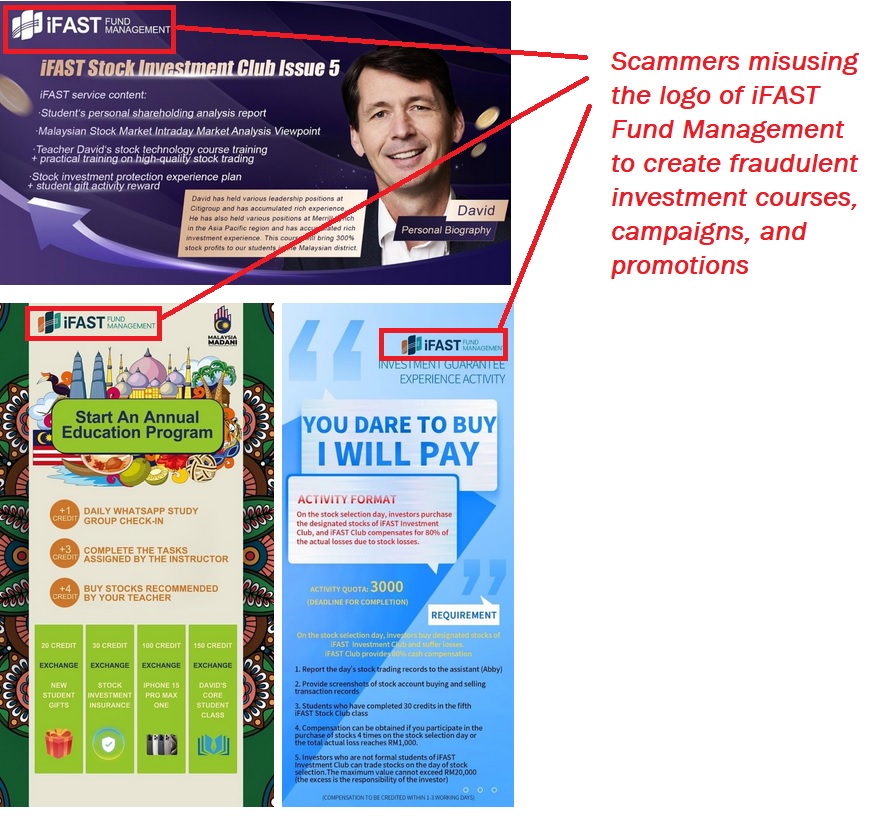

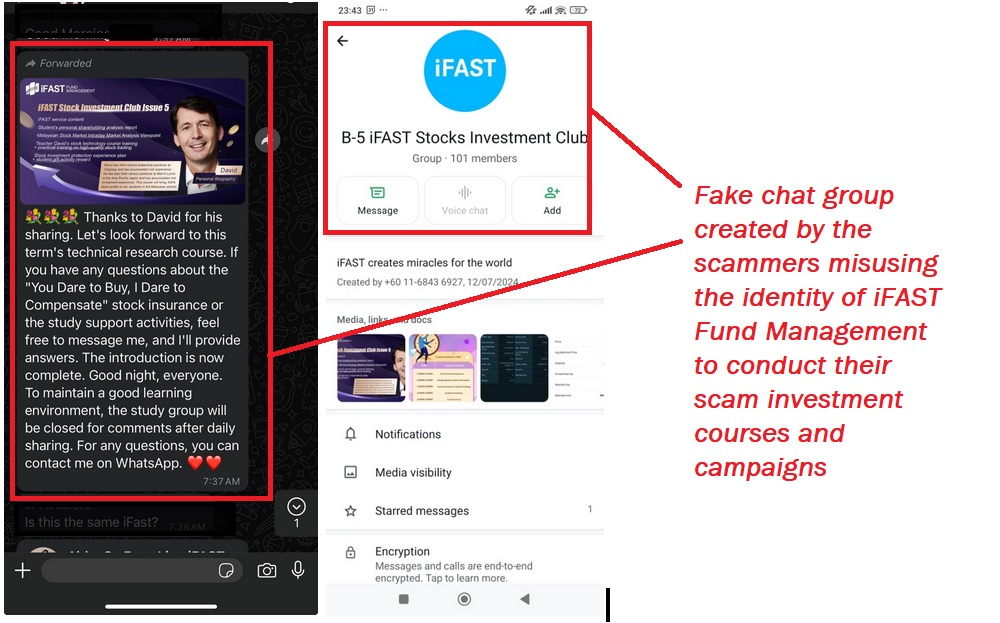

Scammers misusing the iFAST Fund Management branding to operate fraudulent investment courses and campaigns:

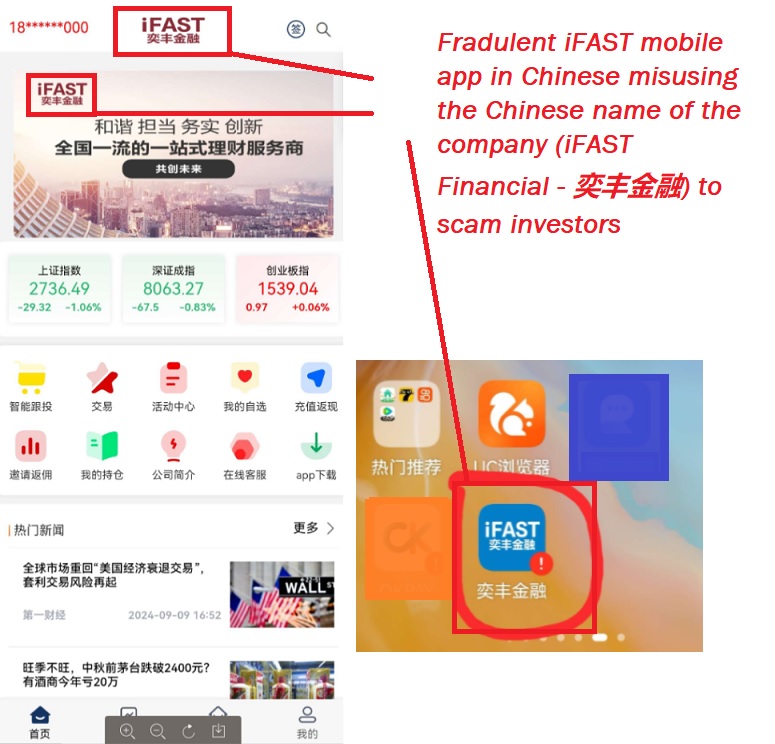

Fraudulent mobile app in China misusing the Company’s Chinese name:

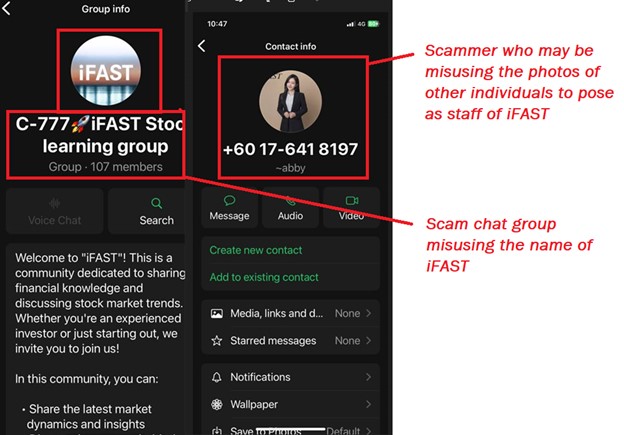

Scam chat group on Whatsapp misusing the name of the Company:

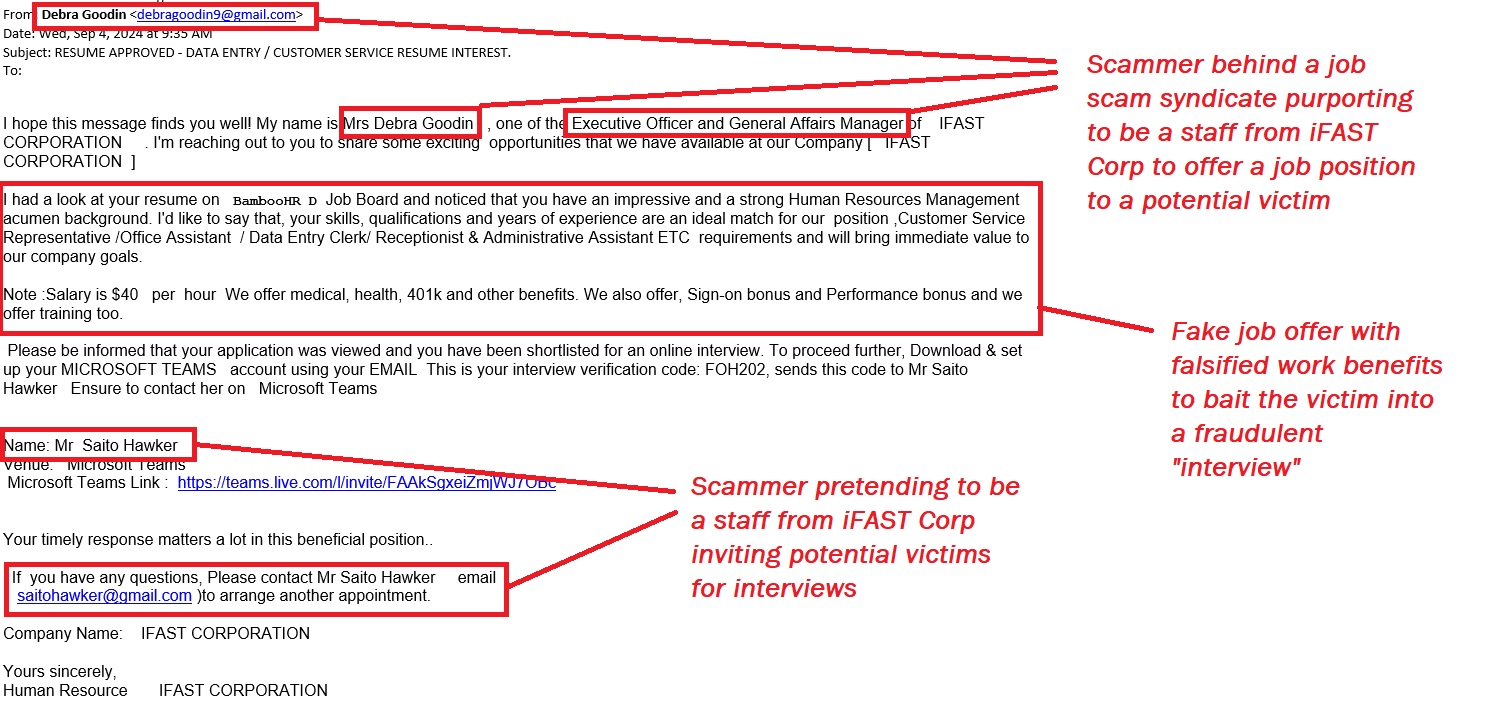

Job scam from an individual purporting to be a manager from iFAST Corp:

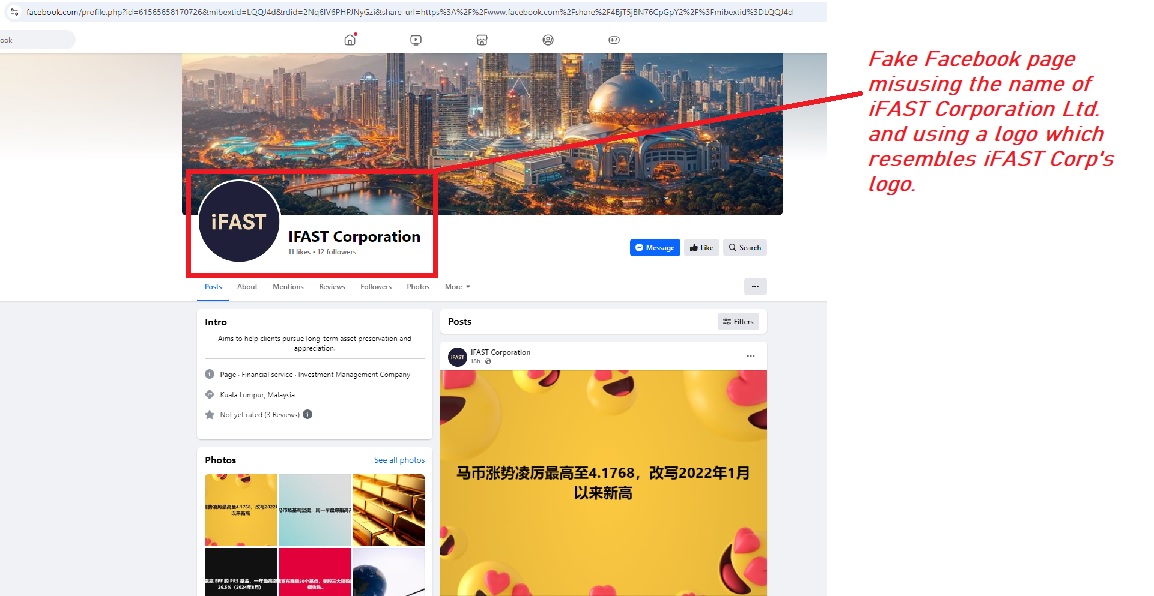

Fake Facebook page misusing the logo of iFAST Corp :

LinkedIn - https://www.linkedin.com/company/ifastcorp

Instagram - https://www.instagram.com/ifastcorp/

Note: FSMOne.com, the Business-to-Consumer (B2C) division of iFAST Corp only operates in Singapore, Hong Kong and Malaysia.

Note: The official iFAST Global Bank mobile app has iFAST Global Bank spelt out in full

Note: iFAST Corp and our subsidiaries will never use our personal email accounts during hiring. For more information on job scams, please refer to our previous Security Advisory article

Note: The official social media accounts of iFAST Corporation Ltd. are as follows:

References:

Singapore Police Force - Mid-Year Scams and Cybercrime Brief 2024 (Published on 19 August 2024) – URL Link: https://www.police.gov.sg/-/media/07167F3D6D6D4C44877BB67A1B219285.ashx

Singapore Police Force - Police Advisory On Investment Scams (Published on 19 August 2024) - URL Link: http://www.police.gov.sg/media-room/news/20240814_police_advisory_on_investment_scams

Singapore Police Force - Trending Scams in the Past Week 2024-16 (Published on 19 August 2024) – URL Link: https://www.police.gov.sg/-/media/428FF9CC663C4EDFBA01D3CCD1A6D063.ashx

Singapore Police Force – Monthly Scams Bulletin (Published on 6 September 2024) – URL Link: https://www.police.gov.sg/-/media/7F27E7269C7F44F0A278D23C569A354D.ashx

Channel News Asia – Telegram scams up 137.5% in Singapore as overall scam cases rise in first half of 2024 (Published on 22 August 2024) – URL Link: https://www.channelnewsasia.com/singapore/scams-rise-first-half-2024-singapore-police-force-mha-4558196

Channel News Asia – Grab driver in SGX market manipulation case gets jail and fine of more than S$355,000 (Published on 19 Dec 2022) - URL Link: https://www.channelnewsasia.com/singapore/sgx-market-manipulation-case-grab-driver-kenneth-goh-jia-poh-jail-and-fine-telegram-group-3154701

The official URL link of iFAST Corporation Ltd. is www.ifastcorp.com

For any doubt or clarifications, please reach out to iFAST Corp at corpcomms@ifastfinancial.com, or contact iGB at clienthelp@ifastgb.com or Live Chat on www.ifastgb.com.

To find out more about iFAST Corp, contact us at (65) 6535 8033 or visit our website at www.ifastcorp.com

Singapore • Hong Kong • Malaysia • China • UK